In commercial real estate, APOD stands for Annual Property Operating Data. It is a financial statement that provides a snapshot of a property’s income and expenses over the course of a year. An APOD is an handy tool for quickly getting up to speed on a new property. By providing a clear and concise overview of a property’s financial performance, an APOD can help investors and real estate professionals quickly assess the potential profitability of a property and make informed decisions about their investment strategy.

The primary purpose of an APOD is to provide an objective analysis of a property’s financial performance, which is essential when making informed decisions about potential investments or financing options. An APOD typically includes a breakdown of a property’s income sources, such as rent and other revenues, as well as a detailed analysis of its expenses, such as property taxes, insurance, utilities, and maintenance costs.

One of the key benefits of an APOD is that it provides investors and real estate professionals with a comprehensive view of a property’s financial health. For example, an APOD can help identify potential areas of risk, such as high expenses or low occupancy rates, which could impact the profitability of a property. Similarly, an APOD can highlight areas of strength, such as high rental income or low expenses, which can increase the potential for positive cash flow and a strong return on investment.

Another important benefit of an APOD is that it can be used to compare the performance of different properties. By providing a standardized format for analyzing financial data, an APOD makes it easy to compare properties across different markets, asset classes, and investment strategies. This can be particularly useful when evaluating potential investments or when developing a broader investment strategy.

To create an APOD, a commercial real estate professional typically gathers financial data for a property over the course of a year. This data is then analyzed and organized into a standardized format that includes a breakdown of income and expenses, key financial metrics, and other relevant information. The final APOD is then used as a tool for evaluating the property’s financial performance and for making informed investment decisions.

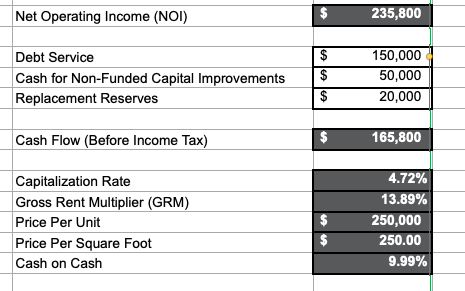

When analyzing an APOD, there are several key financial metrics that investors and real estate professionals typically focus on. One of the most important of these is net operating income (NOI), which is calculated by subtracting a property’s operating expenses from its gross operating income. NOI is a key indicator of a property’s profitability and can be used to estimate its potential return on investment.

Another important financial metric that is typically included in an APOD is cash flow. Cash flow refers to the amount of money that is generated by a property after all operating expenses and debt service have been paid. Positive cash flow is generally considered to be a key indicator of a property’s financial health, as it can be used to cover operating expenses, pay down debt, and provide a return on investment to the property’s owners.

Return on investment (ROI) is another important financial metric that is typically included in an APOD. ROI refers to the amount of money that an investor can expect to earn on their investment in a property over a given period of time. This metric takes into account both the property’s net operating income and any additional costs or expenses associated with owning and managing the property.

In addition to these key financial metrics, an APOD may also include information about a property’s occupancy rates, rental rates, lease expirations, and other relevant data points. This information can be used to identify potential areas of risk or opportunity and to develop a broader investment strategy that takes into account the unique characteristics of a particular property or market.

It is worth noting that there are some limitations to the use of an APOD when evaluating potential investments. For example, an APOD is only as accurate as the financial data that is provided, and there are a number of factors that can impact a property’s financial performance that may not be captured in the APOD. Similarly, the APOD does not take into account broader market conditions, regulatory factors, or other external variables that may impact a property’s value or performance.

Despite these limitations, an APOD remains a useful tool for analyzing the financial performance of a commercial property. By providing a clear and concise overview of a property’s income and expenses over the course of a year, an APOD can help investors, owners, managers, and real estate professionals make informed decisions about potential investments, develop broader investment strategies, and manage their portfolios more effectively.

If you’d like some sample spreadsheets to create an APOD for a property you own or are considering, don’t hesitate to contact us.