In real estate, we often deal with two different types of “escalation clauses.” The one that most people are familiar with after the crazy residential market of the last few years, is the clause in a residential real estate offer that modifies the sales price on the offer based on other offers the sellers might receive. That’s not the one I’m talking about here.

The second type of escalation clause are the ones we often see in commercial leases. The purpose of this type of clause is to effectively modify the lease rate annually to compensate for inflation that might devalue the value of the lease to the landlord. Prior to this last year or so, they were pretty straight forward little clauses. Often times, a tenant would offer the landlord an escalation clause that stated the lease rate should increase by 2.5% annually. The landlord always wanted 3% annually. And, depending on the motivation on both sides of the transaction, a compromise would be reached.

Sometimes these escalators were carried over into the lease renewals, and sometimes the lease renewal would be based on something completely different…I’ll write about those later.

Today, landlords with multi-year leases are realizing that 2.5% or even 3% escalators weren’t enough to protect them from the rapid rise of inflation. We jumped 4.7% in 2021 and are already on track for over 9% in 2022. In response, we’re seeing landlords starting to include much more comprehensive escalation clauses, often times linked to things like the Consumer Price Index (CPI). For tenants, this can cause an uncomfortable risk in their new lease. Linking their payment directly to the CPI, can mean that their lease payment could surge in a single year. Tenants are often responsibly for property maintenance, repairs, insurances, etc through what is called triple-nets and Common Area Maintenance fees (CAMs). Of course these costs are also impacted by inflation. The result is a lot of risk on the tenant side of the negotiation.

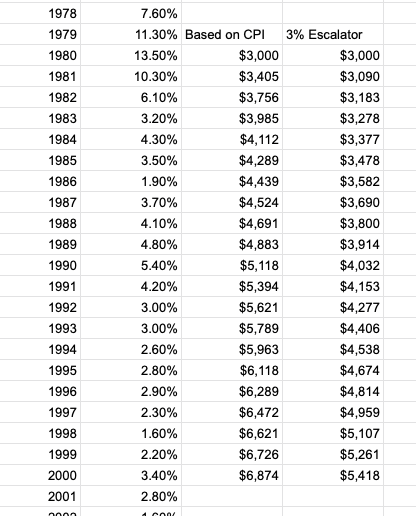

Recently, we just ran the above calculations for a client that was looking at a CPI-based escalator in a 20-year commercial lease. For comparison purposes, and to use some real historic data, we used the example of a tenant signing a lease in 1980 for $3,000 per month. We then compared that lease rate under the CPI-escalator and a more traditional 3% escalator. As you can see, although the annual inflation over those 20 years was only a bit over 4%, the final year of lease payments were 27% higher in the CPI-based model.