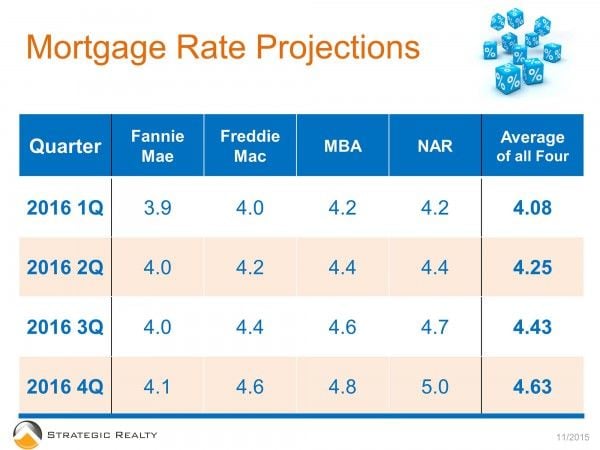

As Rick Blaine says, “Maybe not today, maybe not tomorrow, but soon and for the rest of your life.” We all know that interest rates cannot stay as low as they have over the last several years. But, honestly, I’ve almost worn myself out predicting the rise.

For the last three years, we’ve agreed with industry experts that we would likely see a 1% rise in interest rates over the following 12 months. Each of those predictions was based on solid evidence, historic precedent, and prudent thinking. However, the market has continued to enjoy this very incredible period of ridiculously low interest rates.

A one-percent rise in interest rates doesn’t sound like a whole lot. And in reality, it’s not. Especially when you compare it to where interest rates have been historically. For many of our parents, and grandparents, the fear of a 5.5% mortgage rate would seem absolutely absurd. Most of that group have memories of purchasing real estate with mortgage rates in excess of 15%.

So, does a small rise really matter?

It could. Especially in markets where buyers are finding it difficult to afford what they need, and that’s why it matters to Bend and Central Oregon. A 1-point rise in a 4% interest rate is still only one percent in additional interest rate. But, it is also true that it represents a 25% increase in the interest payment on the mortgage. And 25% is significant, perhaps even critical, in markets where affordability is already a struggle.

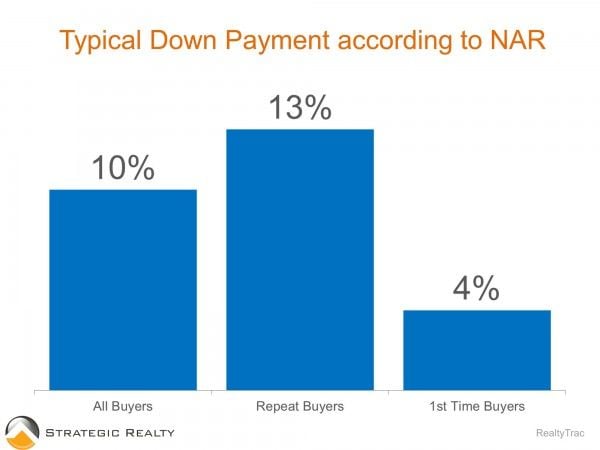

To a family or individual that is struggling to purchase their first home in Bend, Oregon, that one percent rise has significant effects on their price range. Mortgage availability has come back around, to a large extend, which means our hypothetical buyer will likely be able to find low-downpayment financing options. Of course, those options are completely dependent on the buyer’s income qualifying for the loan payment. And, because first-time buyers are taking advantage of low-down payments, the interest they’re being charged on their mortgage debt causes a large swing in the home they can afford.

To a family or individual that is struggling to purchase their first home in Bend, Oregon, that one percent rise has significant effects on their price range. Mortgage availability has come back around, to a large extend, which means our hypothetical buyer will likely be able to find low-downpayment financing options. Of course, those options are completely dependent on the buyer’s income qualifying for the loan payment. And, because first-time buyers are taking advantage of low-down payments, the interest they’re being charged on their mortgage debt causes a large swing in the home they can afford.

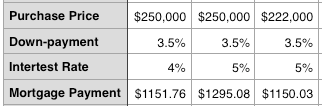

In and around the City of Bend, as I write this, there are roughly 611 single-family homes for sale. Of that list, only about 15 of them are under $250,000. If you’re a homebuyer qualifying for a FHA loan with 3.5% downpayment, a 4% mortgage rate on your $250,000 purchase would make your principle and interest payment about $1150.

Now raise the interest rate to 5%. If your income demands that your payment stay in that $1150 range, your purchase power just dropped to about $222,000. Want to know what that does to your selection? You now get to choose between two homes. One that is being advertised for auction, and a 748 sf home on .07 acres that is advertised as needing some “TLC”.

The bottom line?

If you’re going to need to buy a home next year, you might want to buy it this year. If you plan on living in the home for a long period of time, the cost of waiting could be even more dire. And if you know of a first-time homebuyer that is talking about purchasing next year, please tell them not to wait. We’ve seen too many people being priced out of the market by appreciation, and the compounding effects of rising mortgage interest rates will accelerate the process.