In these days of increased inflation (I almost said hyperinflation, but thought I should check the definition on that…apparently that’s inflation above 50%…good reality check) many folks are trying their best to hold on to what they have. Cash is a poor reserve of wealth when dollars are buying less and less, and some of our knee-jerk ideas like buying gold just don’t hold up to scrutiny. (It worked in the 1970’s….not since.)

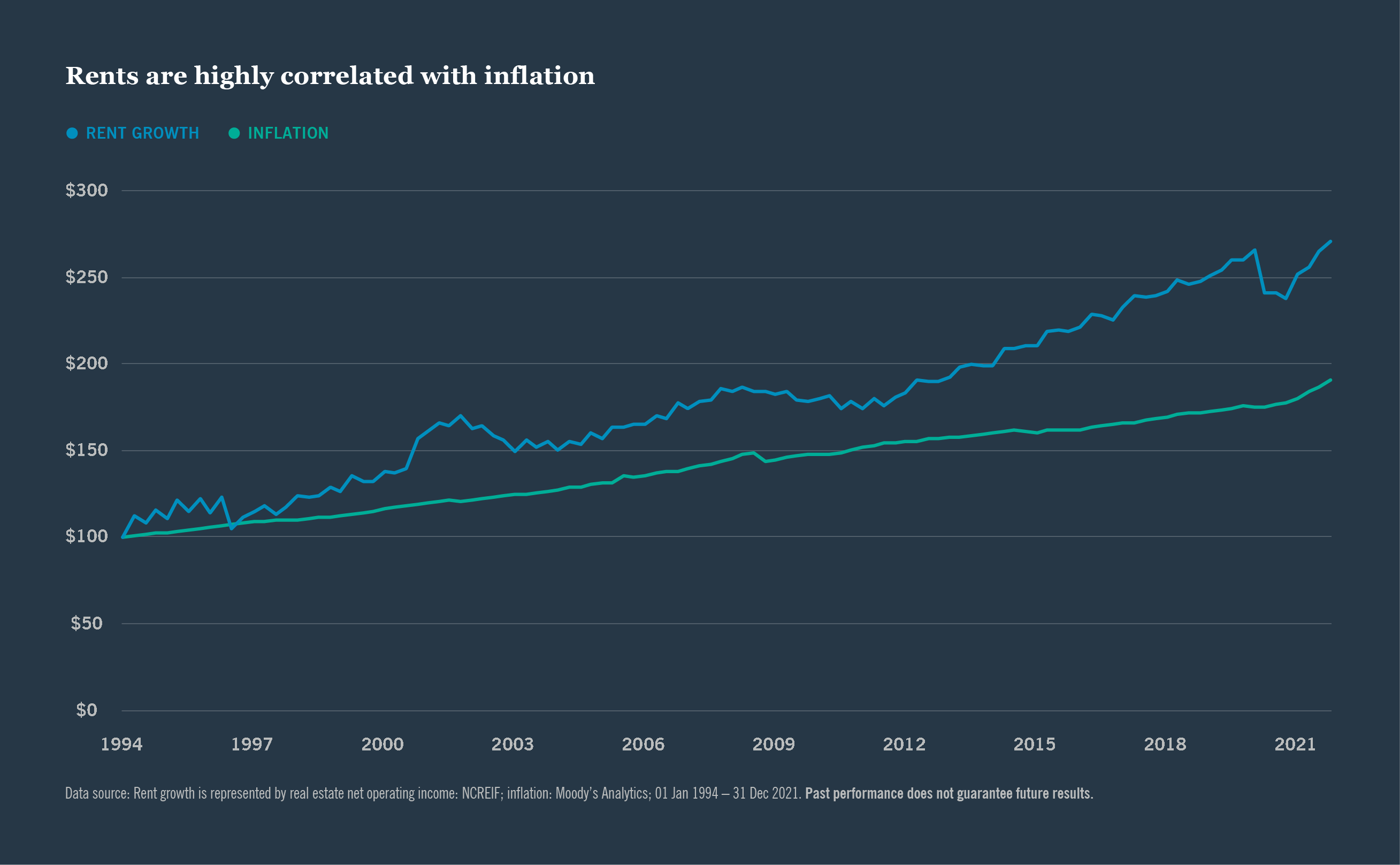

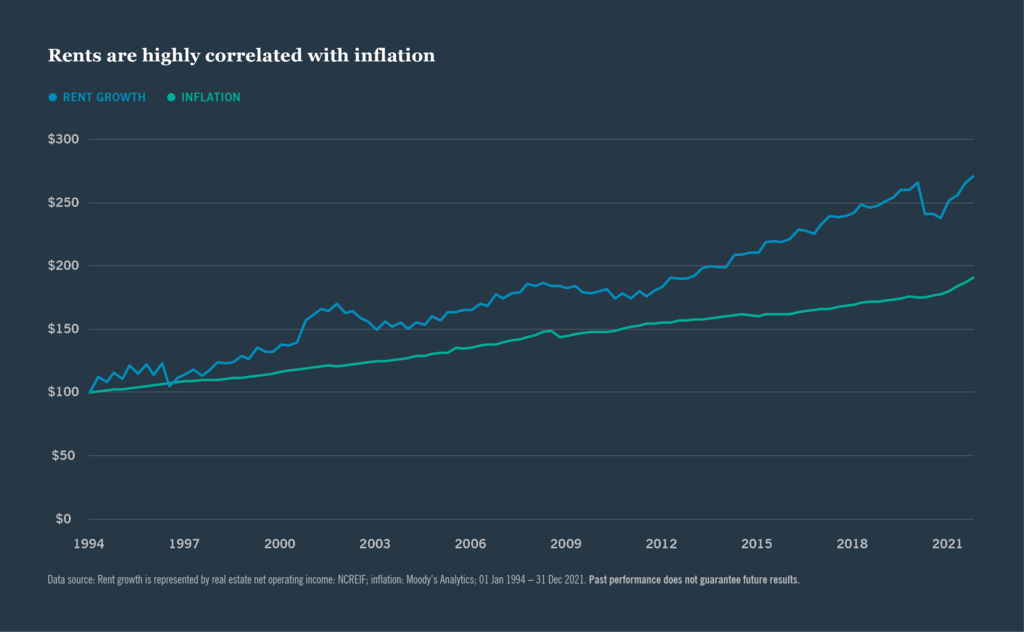

For savvy investors few inflationary hedges are better than income real estate, and there are a few reasons for that. The first, when talking about residential real estate, is that rents have historically kept up with inflation. That’s important because when you’re valuing duplexes, triplexes, quadplexes, and apartments, what they are worth in any market is based on what they rent for. Unlike single-family homes, these products are sold on a gross-rent multiplier or cap rate. When rents go up, value goes up.

To illustrate inflation vs rent, allow me to borrow the excellent graph from Nuveen with all credit and gratitude given.

One of the reasons that real estate tracks so well with inflation is that the competition for real estate product is new real estate product. And construction costs of new real estate product are directly and severely impacted by inflation. On top of those increased material and labor costs, new real estate product relies heavily on bank financing which also increases steeply in inflationary times. All of this combines to prevent demand from being quickly satiated with new supply.

Footnote: So it makes sense to buy income real estate in today’s market (obviously not every deal is a winner), but what if you’re one of our clients who bought income real estate ten years ago? The appreciation of those properties has been significant, and, in the case of single-family homes, eye-watering. You were probably just considering selling those assets 6 months ago, when inflation started to give you a reason to hold on. The answer is…it’s time to reevaluate the portfolio. Not all income properties are the same, and it’s important to know which you want to be holding in this market. Ask us, and we’ll be happy to help.