Sometimes the past is hard to forget. The real estate market in this county has been through some incredible highs and lows over the last 10 years and it has been difficult for even some professionals to wrap their head around. For most people, a home purchase is the single largest investment they’ll even make, and making a mistake with that investment has repercussions far into the future. There are a large number of folks in the Central Oregon market that were party to a short sale or foreclosure over the last several years. And even for those that kept their homes, the tough times we went through meant that their credit scores may have suffered. One of the biggest misconceptions about the current mortgage market is that it is difficult to get a loan.

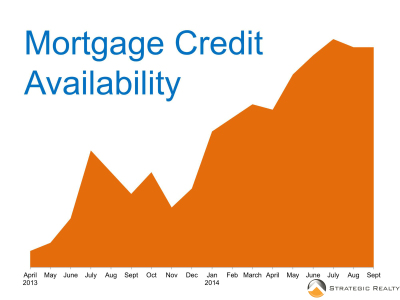

As the graph shows, the availa bility of mortgage credit is much higher than in the recent past and it continues to increase. Banks are in the business of loaning money, and as the economy continues to improve they are rapidly focusing on making mortgage loans in this market.

bility of mortgage credit is much higher than in the recent past and it continues to increase. Banks are in the business of loaning money, and as the economy continues to improve they are rapidly focusing on making mortgage loans in this market.

Both Freddie Mac and Fannie Mae are working to update their loan guidelines to make more money available for mortgage loans in the secondary market. They are also expanding the kinds of loans that can be made.

At the last Mortgage Bankers Association conference just last month, Mel Watt, the director of the FHFA, which oversees Fannie Mae and Freddie Mac, said this:

“To increase access to creditworthy but lower-wealth borrowers, FHFA is also working with the enterprises (Fannie Mae and Freddie Mac) to develop sensible and responsible guidelines for mortgages with loan-to-value ratios between 95 and 97 percent.”

The important thing to remember is at the same time as more mortgages are available, many experts are expect ing mortgage rates to continue to increase. Many people look at increasing mortgage rates as just an added expense. What they don’t often think about is that mortgage rate has an incredible impact on the final price of the house you can afford. This is why we are encouraging many of our clients to make their next move now. If you’re thinking about cashing in on some of the equity you’ve made over the last few years, moving up, or going to stay put for several years in your next house, it makes sense to get it done now. Increasing interest rates can not only cost you more money, they can damper the market for selling your home.

ing mortgage rates to continue to increase. Many people look at increasing mortgage rates as just an added expense. What they don’t often think about is that mortgage rate has an incredible impact on the final price of the house you can afford. This is why we are encouraging many of our clients to make their next move now. If you’re thinking about cashing in on some of the equity you’ve made over the last few years, moving up, or going to stay put for several years in your next house, it makes sense to get it done now. Increasing interest rates can not only cost you more money, they can damper the market for selling your home.

Talking to a loan officer or mortgage broker is a painless process, but still few clients know how much they can afford before walki ng into our office. For a variety of reasons, we feel that finding a mortgage professional you trust is an important second step in any real estate move. Let us know that you would like a recommendation on a mortgage professional and we can provide you with some choices.

ng into our office. For a variety of reasons, we feel that finding a mortgage professional you trust is an important second step in any real estate move. Let us know that you would like a recommendation on a mortgage professional and we can provide you with some choices.