If you’ve been contemplating home improvement, especially those that help the environment while reducing monthly expenses, this is a great year to get started on them.

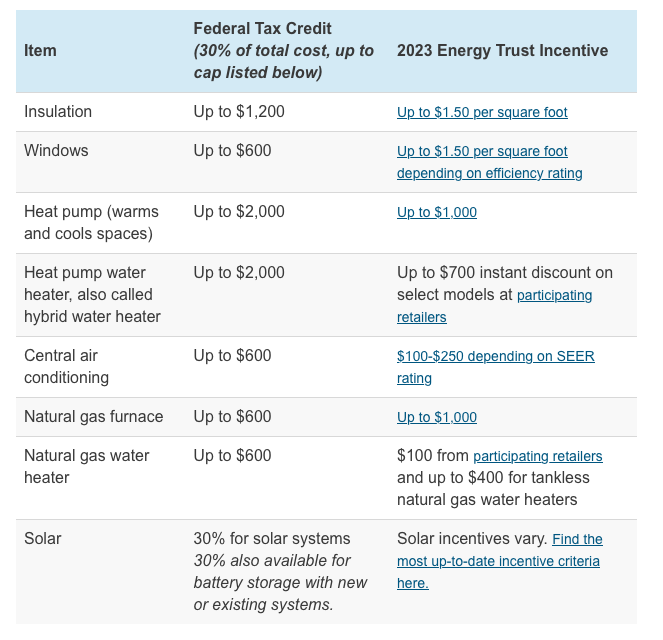

In 2002, Congress passed the Inflation Reduction Act (IRA) which dramatically increased the tax incentives on many home improvements related to energy savings. In Oregon, we’re fortunate to have a non-profit organization that can not only help you navigate through some of these potential savings, but in many cases, add cash incentives themselves. EnergyTrust of Oregon helps businesses and individuals save on their energy costs and improvements and they are a great resource when evaluating some of the Federal incentives that you may be eligible for.

With the passing of the IRA, you may be eligible for up to $14,000 via the “high-efficiency electric home rebate program.”

Income caps apply, but you may get to that maximum by buying efficient, electric appliances: $1,750 for a heat pump water heater, $8,000 for a heat pump that heats and cools their home, and $840 for an electric stove or an electric heat pump clothes dryer.

You can also get rebates on non-appliance upgrades such as $4,000 for an electric load service center upgrade; $1,600 for insulation, air sealing and ventilation; and $2,500 for electric wiring.

In most instances, rebates can be combined with tax incentives plus other cash incentives from place like EnergyTrust, so the savings to homeowners is really significant.

Pro Tip: To get the maximum savings out of these programs, phase your improvements over a few years when practicable. That’s because of the annual limits on savings. For instance, windows are capped at $600, but that cap renews every year for the next decade or so. By phasing your improvements you’ll be able to save money each and every year.